Robo-advice and the cost of convenience

Thinking about using a robo-advisor? It could cost you.

Published: Wednesday, December 1st, 2021

Key points:

- Self-directed management remains a competitive alternative to robo-advice and traditional active management.

- Using a robo-advisor can delay retirement by 2-5 years compared to self-directed management.

- Robo-advisors will likely become more competitive in the future.

In 2021, 3.5 million adult investors will trust a robo-advisor to manage their portfolio. When it comes to investing outside of a 401(k), the convenience offered by automated investing is undeniable. Combined with the fact that 92% of human managers underperform the S&P 500, it’s no wonder why folks are giving the machines a chance.

You have to give the robo-advisors credit for making the process of investing so simple – simply set up an account, configure your risk tolerance and away you go. Whatever funds are transferred in get automatically invested. Some robo-advisors even offer automated tax-loss harvesting to further juice after-tax returns.

Self-directed investing, on the other hand, is way more hands-on. You’re confronted by intimidating terminology like ‘bid/ask price’, ‘market/limit order’ and so on. Being routinely exposed to your portfolio balance in this manner can invite the temptation to day trade, fat-finger a trade, or be fallen to a temporary lapse in judgement.

And even if you have nerves of steel, you have to wonder what your time is worth. As a general rule, if a machine can do it, it’s probably not worth your time. Right?

In this post we put a price on that convienience and quantify what automation actually costs in 2021.

The cost? Your life.

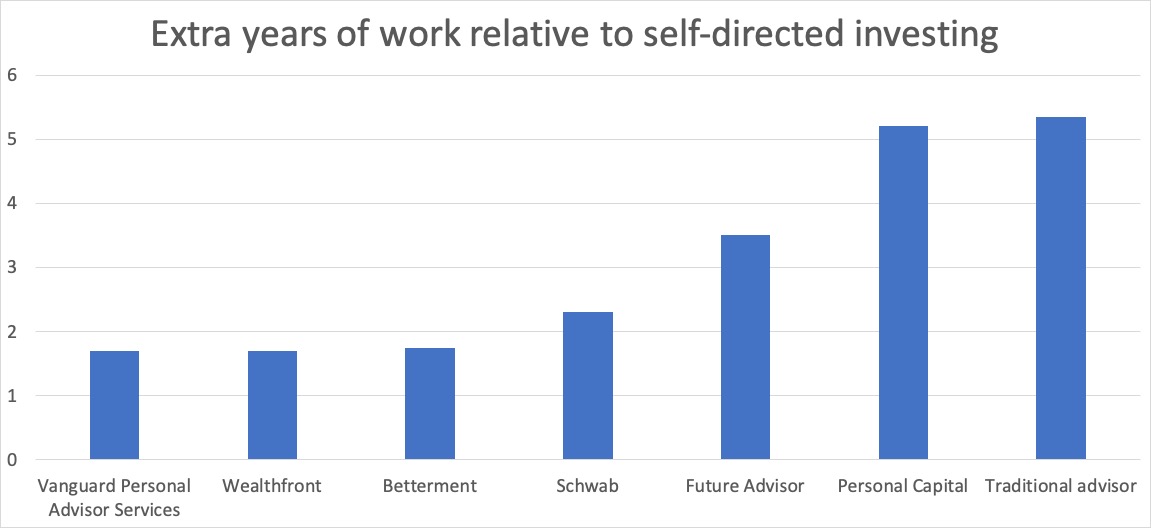

Using Nesteggly’s Ultimate Retirement Calculator, we compared how many extra years you’d have to work in order to cover the cost of the most popular robo-advisors versus self-directed passive index investing. The result was staggering - robo-advisors delayed retirement anywhere from two to five years.

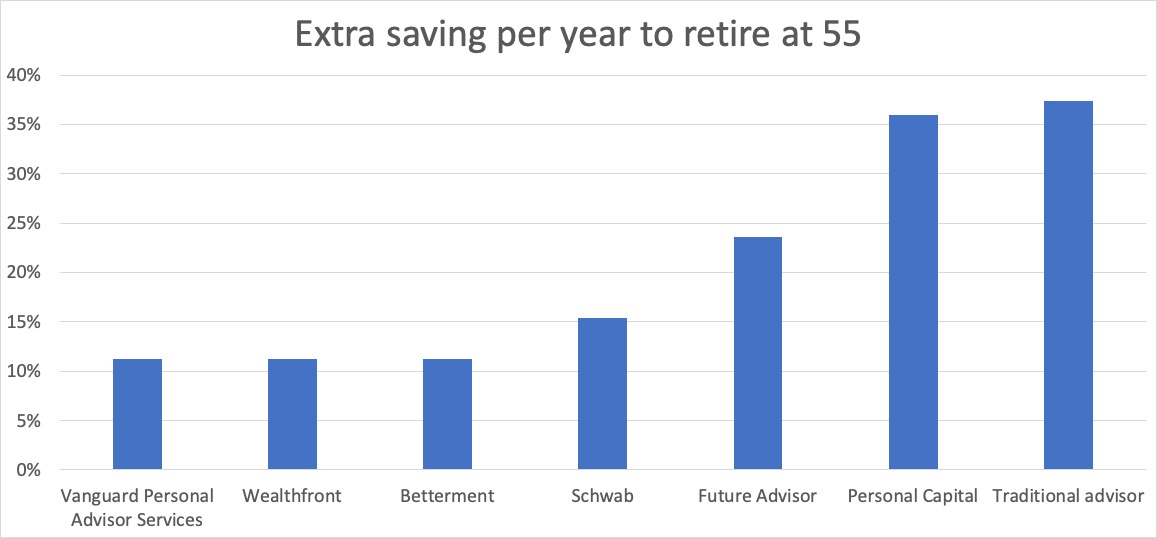

To look at it another way, we calculated how much extra saving you’d have to do per year in order to overcome the effects of robo-advisor fees and stay on track to retire at the same age you would have retired with the self-directed method. We estimate you’d need sock away an extra 11% to 37% per year.

We assumed the robo-advisors performed roughly the same, and that their performance mimicks that of the S&P 500 index. We also assumed robo-advisors don’t ever change their current fee structure (more on that later).

Breaking down the costs

Robo-advisors typically collect fees two ways:

- Management fees.

- Hidden fees. Typically, these are fees built into the funds that the robo-advisor is purchasing on your behalf. In the case of Schwab’s robo-advisor, this cost manifests as a 6% cash allocation, which one of the main ways they make money (and also why they’re presently being sued).

Here’s a breakdown of the fees for each robo-advisor:

| Robo-advisor | Management fee | Hidden fees | Total fees |

|---|---|---|---|

| Vanguard | 0.30% | 0.06% | 0.36% |

| Wealthfront | 0.25% | 0.11% | 0.36% |

| Betterment | 0.25% | 0.11% | 0.36% |

| Schwab | 0% | 0.47% | 0.47% |

| Future Advisor | 0.5% | 0.18% | 0.68% |

| Personal Capital | 0.89% | 0.08% | 0.97% |

| Traditional advisor | 1% | 0% | 1% |

These management fees act as a ‘tax’ on the performance of your portfolio. So if the performance of your assets was 6% per year, a 0.5% management fee would reduce that return to 5.5%.

As a self-directed investor, you can passively invest in the S&P 500 index for as low as a 0.03% fund fee via Vanguard. Fidelity offers index funds with a 0% fee, but watch out for taxable events generated by those funds if you’re holding them in a taxable account.

Takeaways

For small sums of money, robo-advisors can still make a lot of sense. And I’d wager a lot of people fall into this category – that awkward situation after you max your retirement accounts and have some loose change left over. In this case, using a robo is probably way more favorable than just letting it sit around in a checking account.

But when it comes to your life savings, it doesn’t how much you make at your day job – the prospect of working another 2-5 years in exchange for the convienience of a robo-advisor should make you wonder if it’d be worth going it alone. Given all the competition in this space, I anticipate it’s only a matter of time before robo-advice gets cheap enough to make it a no-brainer. But in 2021, it’s clear that we’re simply not there yet.